The financial markets have been breaking up the monotony of the bull run we have enjoyed for the last two, arguably six, quarters. We are seeing a market correction happen in light of all the coronavirus news which has the media in a frenzy. With everything going on, how can you as an investor make the best of the current market downturn. Here are a few tips I’d like to share on how to build wealth during a market downturn and my thoughts on them.

If you have a long time horizon for your invested dollars (7-10+ years) then buy, buy, buy! I’m often asked what to do when the market is falling and typically hear “I don’t want to lose any more money.” First of all, you only lose money when you sell your investments at a loss. The gains or losses while you are holding the investments are called “unrealized gains or losses” which means they are just calculations at that given point in time. You don’t “realize” the gains or losses until you offset your position in that investment. Secondly, here in Northeast Wyoming I work with many hunters, myself being one, so I ask the question “If Cabela’s or Sportsman’s Warehouse was to put on a sale where everything was 10% off, 40% off, or 70% off, what would you do?” The common answer I get is go buy new hunting gear for the upcoming seasons. I explain the market is the same way. The S&P index is having a 12%+ off sale, so buy, buy, buy!

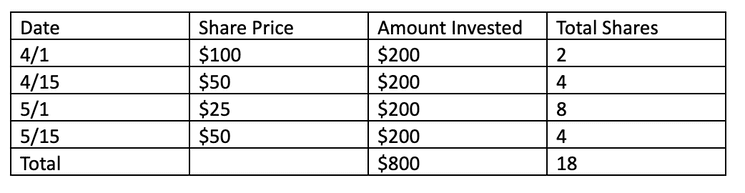

Along those same lines, there is a mathematical rule in investing called Dollar Cost Averaging , which can be a huge benefit during market corrections. Many people systematically contribute to their retirement accounts, college savings accounts, or save money every month or every two weeks. This systematic savings not only builds the habit of paying yourself first (more on that in another article), but also lays the foundation for a great advantage during market dips. Here’s how it works: Dollar cost averaging says that the average cost per share is cheaper than the average price paid per share. Here is an example:

In this example, the share price would have dropped and rebounded some but not completely up to the original level. The average share price over the six weeks was $56.25 ($100 + $50 + $25 + $50 / 4) but the average cost per share is only $44.44 ($800 / 18 shares). Therefore, by systematically investing, you are able to buy the investment for a lower average cost per share.

Outside of price corrections, the overall economy remains looking quite healthy. The latest jobs report from the BLS showed that total Nonfarm payroll employment rose by 273,000 jobs in January and unemployment remained little changed (BLS). There doesn’t seem to be a bubble of any kind in our economy such as the housing bubble of 2008 or tech bubble of 2001. Mortgage rates have dropped dramatically and are near their 52-week lows and the Feds just dropped the interest rates by 0.50%, but the bond yield curve remains fairly steady and has not inverted (WSJ). Although rate cuts are not necessarily positive signs for the economy, to you as the consumer, this can be advantageous if you have debt which needs refinanced as part of your financial plan.

So how can you be opportunistic during these turbulent times? First of all, if you are systematically investing money – don’t stop, just keep putting money away. All this is cyclical and will pass. Secondly, set up a time for us to go over your portfolio to double check that you are properly diversified with your investments for your risk tolerance. This will help even out the ebbs and flows you feel through periods of a volatile market. And lastly, update your financial plan. If you do not have a financial plan that you are taking intentional action on, please contact us so we can put one into motion to help you accomplish your goals quicker.

It’s that time of year again where we need to look at our goals and dreams and what we want to change to better ourselves for this new year. But this year not only is it a new year but a new decade. If you are one of those people who start a new routine on a Monday or the first of the month, then this is your time! A time when we can make a big change in our lives. Maybe one of those changes is being more fiscally responsible, or getting on track with your financial goals, or just being able to achieve the feeling of financial security. Whatever the reason is, here are a five reasons why you should talk to a financial advisor in January 2020.

1. Get past the intimidation factor . If you feel like you haven’t done a very good job of managing your personal finances, it can be easier to just try to ignore that fact than go seek help. At this point in my career, I have been in the industry for five years and probably half of my clients have each “had the worst mess I’ve ever seen”, or so they thought. Honestly, none of them have been. The worst mess is when someone intentionally ignores their personal financial clutter in hopes that one day they will win the lottery and that will magically solve all the problems. (Side note – if you win the lottery, then you REALLY need a financial advisor!) If you are serious about making a change in your life, partner with someone who can help make that happen.

2. Intentional Cash Management . Believe it or not, there are ways where are you can feel like you have more money, and grow your wealth faster, on your same income. It’s all in how you manage your cash. When your paycheck comes in, what happens to it? Do you have a plan with that? A financial advisor can help you set a practical and intentional budget that aligns with your goals and manages your cash properly; not only for the next two weeks but for the year. Imagine what Christmas would be like if it didn’t surprise you every year and break your budget every year.

3. Get on track for long term goals . Right now, can you tell me that you are contributing enough to your retirement to be on track? And can you tell me how much that is? How about saving for kids’ college? New cars? Second home? Starting a business? Being on track for your long-term goals largely is knowing that you are taking intentional steps to achieve those goals at the given date in the future. Not only that but being the most efficient at it. a financial advisor can help you craft the plan to achieve your long-term goals. Remember the old saying – a journey of a thousand miles begins with the first step.

4. Review or create a risk management strategy . To have a complete plan, you must look at what could wreck the plan, throw it off course, or make you start completely over. What happens if you were injured and couldn’t work for two months, two years, or twenty years? If you are the primary income in your house and something happened to you, what would the rest of your family do? If you own a business and became involved in a lawsuit, are you taking steps to limit the liability? These are tough conversations, but proper use of certain insurances and legal structures can mitigate these risks and be cost effective.

5. Review or create your estate planning . This can be an easy check mark or a difficult one. If you own anything, you should have something set up to direct that to who you would like to receive it in the event you pass away. This can be through beneficiary designations, wills, trusts, or other means. Consulting with an estate planning attorney your financial advisor recommends may be necessary to properly set up what you would wish to happen to your assets. If you have already done your estate planning, it is still good to review your information to make sure your situation hasn’t changed and what you wish to happen is what is set up.

Thinking of all these items could be intimidating, but having a financial advisor to coach you back on track will rebuild confidence in your financial decisions. Maybe you have a couple question marks next to some of these items, and a financial advisor can provide a second set of eyes to analyze your progress. No matter the stage you are at, it is wise to have a professional assist you in starting your new decade off strong.

Yours in wealth,

Josh Pierce

Here’s where the rubber meets the road: Why would you get up every day and go to work to earn money just to spend it in the next 2-4 weeks, instead of creating a second income with it, buying a new home, car, tractor, or RV, starting a business, or whatever your dreams and goals are? A financial advisor’s job is to help you make smart money decisions so you can achieve your goals quicker.

In today’s society, it seems young adults have a harder time than ever to figure out the complexities of personal finance and making responsible decisions. It’s true, there is more information available to us at our fingertips, but there are equally enough scams that can be damaging to what could otherwise be a bright future. In this article, I will answer your common questions about financial advisors.

What does a financial advisor do?

Imagine if you could have someone to help you make sure you are budgeting correctly to not only have a comfortable living today, but also putting money away to grow your net worth and achieve your goals. Or to make sure you are on track for retirement and investing your money in appropriate investments with the most tax advantages. Or someone to help you craft a strategy to reduce debt the fastest. Or someone to call to review the latest business opportunity to invest in that you just heard about. These are all areas a financial advisor can help with.

But what about an accountant or a lawyer?

As you develop in your adult life, you need a team of professionals with your best interest in mind. Accountants and Lawyers sometimes can give financial advice, as long as it’s incidental to their profession. But if having an accountant and lawyer was enough, why is there an epidemic going across America of adults that know very little about personal finance or if they are on track for their goals?

I don’t want to be sold some investment or insurance policy…

There needs to be a distinction between a financial advisor and a registered representative or insurance agent. Sometimes called a “financial representative,” these professionals are usually hired by a broker/dealer or insurance company and earn their incomes through commissions. They give apparent free advice, because they are paid when the sale is made, per se. So therefore, in order for them to be paid for their advice it must be targeted for you to buy their investment or insurance product.

Contrast this to a financial advisor, where typically the relationship begins with a contract so each party knows what to expect from the other and a fee is charged. The financial advisor is therefore paid to give you financial advice that is in YOUR best interest, known as a fiduciary obligation, and not advice that will make a sale.

What should I consider in finding a financial advisor?

The first time you meet with a financial advisor, it needs to be similar to an interview for a business partner or your own chief financial officer. It should be a two-way interview where you determine if the advisor is someone you trust and want to work with long term, as well as the advisor determining if you would fit into their practice as a client. When we at JH Pierce first meet with new prospective clients, we need to make sure that you will be a good fit for us to work with. Here are some items we consider that can help you determine if you need a financial advisor.

In addition, Chris Hogan with Ramsey Solutions offers the following seven questions you should consider when finding a new advisor (taken from

, and we will be in touch with you. We can sit down and discuss your questions and your situation to determine if you could benefit from working with a financial advisor. This meeting is just designed to determine if working together makes sense, so there is no charge for an introductory meeting.

If any of this article has sparked questions for you, fill out the

contact information on our website

If you enjoyed this article, please leave us comments below or reach out to us with other topics you’d like to read about.